when does draftkings send out 1099|Where can I find my DraftKings tax forms / documents (1099/ W : Tagatay When will you receive your 1099? 1099 forms are also due to recipients on January 31. You should receive yours by mid-Februrary. What if you don’t receive a tax .

We would like to show you a description here but the site won’t allow us.

PH0 · Where can I find my DraftKings tax forms / documents (1099/ W

PH1 · Where can I find my DraftKings tax forms / documents (1099/ W

PH2 · What are the 1099

PH3 · Understanding Your DraftKings Tax Withholding: Key Strategies

PH4 · Tax Considerations for Fantasy Sports Fans

PH5 · Started draftkings February 2022. Can someone explain what I

PH6 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH7 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH8 · Key tax dates for DraftKings

PH9 · How to File Your Taxes If You Bet on Sports: Explained

PH10 · DraftKings Tax Form 1099

PH11 · DraftKings

With 80 FREE SPINS for just $1, Zodiac Casino stands out with its unique WELCOME OFFER. You could win $1 MILLION by claiming the 80 spins that ZODIAC CASINO offers its new players. For a small deposit of just $1, you will receive 80 spins (which is credited as a $20 bonus), which you can play on the popular Mega Money Wheel slot game. .

when does draftkings send out 1099*******If you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings. This form will include all net earnings from the prior calendar year.Forms 1099-MISC and Forms W-2G are expected to be available online at the .If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you .

Forms 1099-MISC and Forms W-2G are expected to be available online at the end of January 2024. A separate communication will be sent to players receiving tax forms as . If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you can access the information directly from the Financial Center. You can expect to . When will you receive your 1099? 1099 forms are also due to recipients on January 31. You should receive yours by mid-Februrary. What if you don’t receive a tax .

This article covers how you get your DraftKings sportsbook tax form in addition to how you fill in your DraftKings tax form. We should mention that most bettors should have received their DraftKings 1099 .

If during the year your winnings exceed $600, DraftKings will send you a Form 1099-MISC. As it’s your responsibility to report all income, even earnings under .Yes, you’ll only be taxed on winnings, and only if it’s $600+ at year end. If so they will send you a 1099, if you don’t get that don’t worry about it.

States have collected hundreds of millions in gaming taxes since the Supreme Court overturned the federal ban on sports betting a few years ago, and the . Fantasy sports organizers must send both you and the IRS a Form 1099-MISC or 1099-K if you take home a net profit of $600 or more for the year. Fantasy .

You must be 18+ to play (19+ in AL & NE and 21+ in AZ, IA, LA & MA). Account sharing is prohibited. This site is protected by reCAPTCHA and the Google and apply. The best .

DraftKings customers in the United States aren't taxed on their withdrawals. Learn more about what is reported to the IRS: Fantasy Sports. Sportsbook and Casino. DraftKings Marketplace. Prev How do I opt in to electronic-only delivery of tax forms (1099/ W . Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC.If you receive your winnings through .Agree. Speak with tax professional. I never received 1099 from DK or FD on my earnings (not over $600 individually), but I withdrew over $600 over the course of the year, net earnings from both, and received a 1099 from PayPal.

when does draftkings send out 1099 Where can I find my DraftKings tax forms / documents (1099/ WIf you or someone you know has a gambling problem and wants help, call 1-800-GAMBLER. You must be 18+ to play (19+ in AL & NE and 21+ in AZ, IA, LA & MA). Account sharing is prohibited. This site is protected by reCAPTCHA and the Google and apply. The best place to play daily fantasy sports for cash prizes. Make your first deposit!

I’m pretty sure I won over 600 last year on draftkings. I haven’t received a 1099 yet and based on filing deadlines I believe I was supposed to by the end of janurary. . DK will only send 1099 if your NET earning is $600. . jap5531 • I think I did net out 600. Although it may have been split between draftkings DFS and Sportsbook. I .Taxes - Frequently Asked Questions - W-2G, 1099, winnings and more. This FAQ covers frequent tax questions that we receive about our Online Sportsbook, Daily Fantasy, Racing, Faceoff, and Online Casino products, and the IRS-required “Tax Forms” associated with your play on our products. This FAQ is intended to provide general answers to .Get insight from other users on your lineups, who you should sub in/sit out, and other information about DraftKings. Members Online • . Does anyone know the time frame of when Draft Kings sends out 1099-Misc forms for winnings? My husband withdrew $539 in winnings but he technically won over $600 so I have a feeling they’ll send us a 1099 .

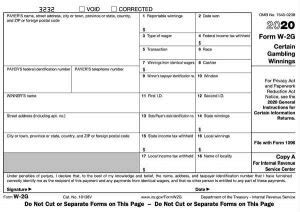

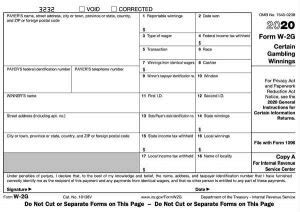

when does draftkings send out 1099 Yes, DraftKings does send tax forms to its users under certain conditions. According to DraftKings’ official website, they will provide Form 1099-MISC to users who have accrued at least $600 in net winnings during the calendar year. This form is used to report miscellaneous income to the IRS.Where can I find my DraftKings tax forms / documents (1099/ W Yes, DraftKings does send tax forms to its users under certain conditions. According to DraftKings’ official website, they will provide Form 1099-MISC to users who have accrued at least $600 in net winnings during the calendar year. This form is used to report miscellaneous income to the IRS.Form W-2G from DraftKings (just sharing) We will issue a W-2G form each time a player has a payout of $600 or more (no reduction for the wagered amount) and a return that is 300X the amount wagered. We will withhold federal income tax from the winnings if the winnings minus the wager exceed $5,000 and the winnings are at least 300 times the . The majority of states have income taxes, which means that gambling winnings are likely subject to both federal and state taxation. For federal taxes, there are two types of withholdings on gambling winnings: a regular gambling withholding (24% or 31.58% for certain non cash payments) and back withholding also at 24%.If you take home a net profit exceeding $600 for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. If you receive your winnings through PayPal, CashApp, Zelle, or Venmo, the reporting form may be a Form 1099-K.

In some cases, the odds (ratio of the winnings to the wager). The information provided by the player on the W-9 (name, social security number, and address) is used by DraftKings to populate IRS Forms W-2G and/or 1099-Misc. In the event your legal name, Social Security Number (SSN), or home address has changed, please fill out an updated W-9. Check out our Frequently Asked Questions web page on how to obtain a replacement 1099. You also may be able to request a replacement SSA-1099 by using our automated telephone service at 1 .

Sam McQuillan. Reporter. States have collected hundreds of millions in gaming taxes since the Supreme Court overturned the federal ban on sports betting a few years ago, and the IRS wants its fair share. As many as 149 million taxpayers could be on the hook for taxes on legal winnings this tax season, 23 million more than last year.We would like to show you a description here but the site won’t allow us.

I received a 1099-Misc of $5,661 from FanDuel and have filed that on my tax return. On Draftkings, I had a yearly loss of $1,300. Can I offset these fantasy sports sites? . You have clicked a link to a site outside of the TurboTax Community. By clicking "Continue", you will leave the Community and be taken to that site instead.

We would like to show you a description here but the site won’t allow us.

You may contact the DraftKings Customer Support Team to request a Win/Loss Statement that details your account activity for a requested time period. To understand how your Win/Loss Statement can be used during tax preparation, DraftKings suggests that you consult with a tax professional. For more information on gambling income and losses .

** Though pricey, Justiciar is now best in slot for helmet and leggings, also check GE prices because they have changed for sure. Don't get a dragon full hel.

when does draftkings send out 1099|Where can I find my DraftKings tax forms / documents (1099/ W